We’re constantly releasing new features within the EvaluAgent platform for contact monitoring and compliance requirements – a number of which will greatly benefit the financial services industry.

The software has been designed to help compliance and operations teams gain insight into how customer service teams are handling inbound and outbound contacts to:

• help mitigate compliance breaches,

• aid training development,

• ensure the organisation is operating within FCA guidelines,

• reduce the likelihood of costly fines and negative exposure.

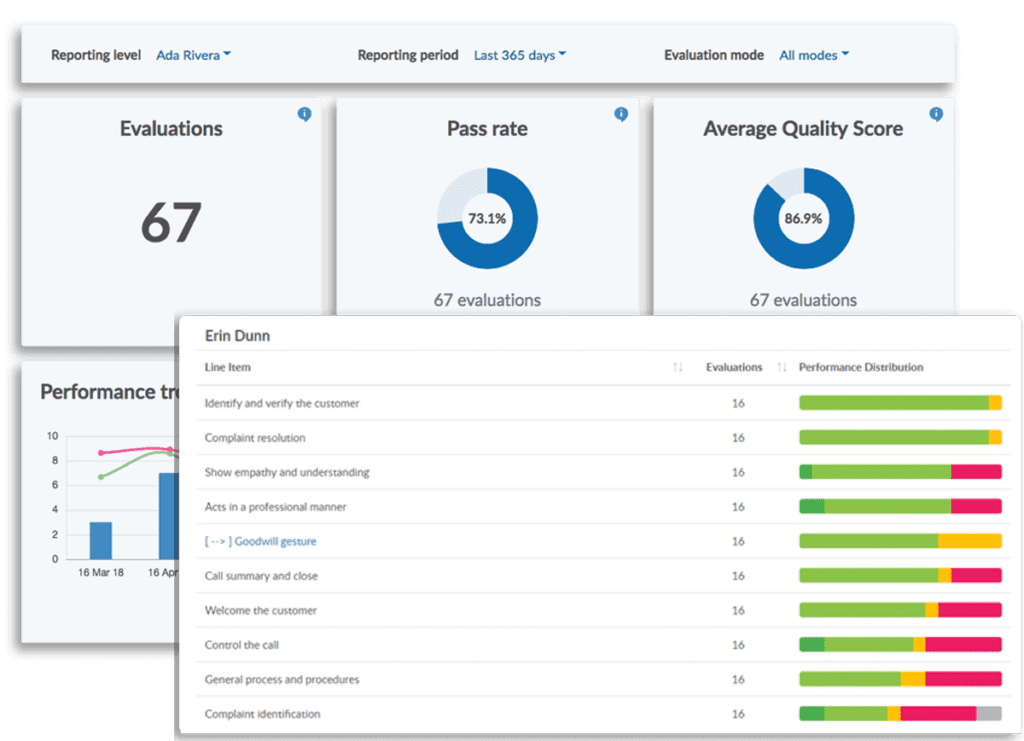

The all-in-one call centre quality monitoring platform has a powerful reporting and analytics

module that can be accessed by relevant managers to monitor performance in real-time and create an accurate record to demonstrate the fair treatment of customers.

Our CEO, Jaime Scott, says “Contact Centres commonly use outdated software, or worse spreadsheets, to manage these processes. Typically, they can be error-prone and unsuitable when trying to engage the modern-day workforce and lead to compliance problems being prolonged and service levels compromised.

“At last Compliance, Operations and Quality teams can easily and quickly obtain the detailed analytics and reporting they need to mitigate any areas of risk.”

“Anyone who is focused on the continuous improvement of staff and customer experience should take a look at the EvaluAgent platform. Customers are telling us that the feedback from regulators has been really positive. You can now clearly demonstrate not only the fair treatment of customers but also a very clear system for identifying areas of risk to the business and a remedial coaching plan for customer service staff.

“We’re excited to bring something so unique to the financial services market.”

The EvaluAgent quality assurance and improvement platform helps you to identify where you are meeting TCF requirements (Treating Customers Fairly), and more importantly where a focus on improvement is needed.

Risks are easily flagged for consideration and using the dashboard and reports feature, you can quickly identify areas where your company and advisers aren’t meeting regulatory standards in order to make necessary improvements.